Real Estate Policies of South Korea’s new president

South Korea’s new administration plans to introduce new policies that will impact the real estate market.

In March 2022, Yoon Suk-yeol of the conservative People Power Party was elected as the new president of South Korea. Yoon will serve for the next five years, with his tenure starting in May. This article summarises the key points of his manifesto regarding real estate.

New housing supply to meet the demand: The pledge includes adding 2.5 million housing units nationwide over the next five years (1.3–1.5 million housing units in the Seoul Capital Area). The new party plans to offer development opportunities to private developers, besides granting tax benefits and relaxing regulations to some extent.

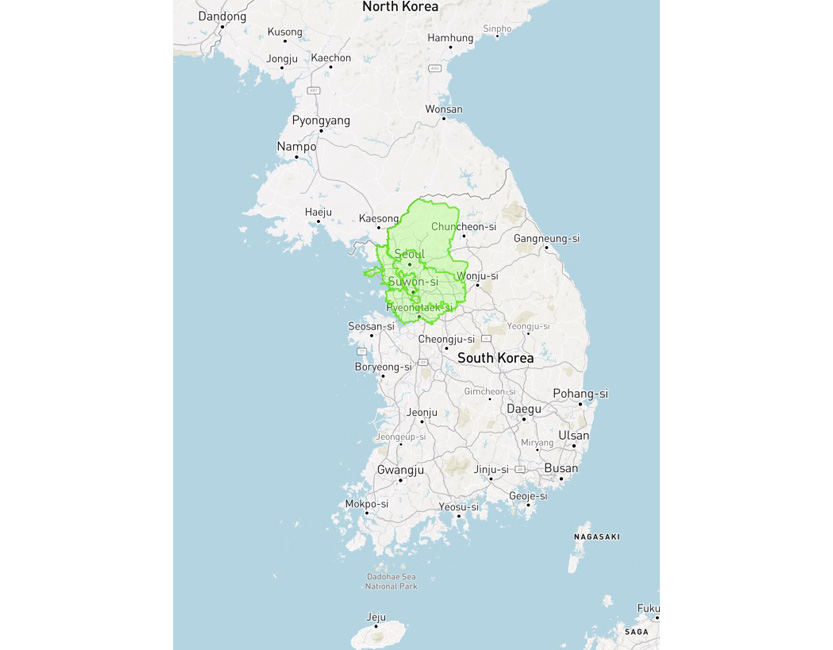

- The new administration aims to increase the supply volume by 20-30% (Refer to Figures 1 & 2). As roughly half of the Korean population resides in Seoul Capital Area (SCA), the upcoming residential supply will be concentrated in SCA.

Figure 1: Location and Composition of Seoul Capital Area (SCA) – Highlighted in Green

Figure 2: Breakdown of New Housing Supply – SCA and Other

| Breakdown of Supply Plan | # of Housing units | |

|---|---|---|

| A | New reconstructions/redevelopments by relaxing FAR restrictions and expediting the permit approval process | Nationwide:470,000; SCA: 305,000 units |

| B | Mixed development in subway area, city hubs and semi-industrial districts | Nationwide:200,000; SCA: 130,000 units |

| C | Development of government-owned land and large parking garages | Nationwide:180,000; SCA: 140,000 units |

| D | Small-scale housing supply through maintenance projects | Nationwide:100,000; SCA: 65,000 units |

| E | Public housing site development including GTX subway area | Nationwide:142,000; SCA: 740,000 units |

| F | Other developments | Nationwide:130,000; SCA: 120,000 units |

Source: People Power Party Manifesto Handbook

Encouragement of redevelopment, reconstruction and remodelling:

Figure 3: New (Proposed) Weighting System for Safety Evaluation for Reconstruction

For reconstructions, the president-elect aims to reduce the weighting on ‘Structural Safety’ and instead increase the weighting on ‘Residential Environment’. Another pledge includes exempting safety evaluation for housing aged 30+ years. The new (proposed) weighting is a part of the plan to introduce sufficient residential supply.

Figure 4: Tax on Property as % of GDP

| Tax on Property (% of GDP) |

2018 | 2019 | 2020 |

|---|---|---|---|

| South Korea | 7th (3.098 %) |

6th (3.113 %) |

2nd (3.976 %) |

| OECD Average | 1.81% | 1.81% | 1.84% * |

Source: OECD

Of the 38 OECD members, the 2020 figure for Australia is not yet published

Relaxation of taxes: In 2020, South Korea ranked second equal amongst developed countries (Organisation for Economic Co-operation and Development) in the ratio of property tax to GDP, behind Canada (4.15%) and tying with France (3.976%). In an effort to lessen the tax burden on housing, the president-elect's manifesto includes the relaxation of three major property taxes: 1) Real Estate Holding Tax, 2) Capital Gains Tax, and 3) Acquisition Tax.

The majority of real estate-related policies are confined to residential real estate. Other manifesto undertakings include but are not limited to increasing FAR, financial subsidies to developers, simplifying the construction permit approval process, restructuring leases and easing loan-to-value (LTV) ratio for first-time homebuyers. It would take some time to evaluate the possibilities and effectiveness of pursuing these pledges. However, the incoming president is likely to stabilise rapidly rising housing prices by providing abundant supply and easing regulations and taxes in accordance with market principles.